Every week since January 2025, The CRO Report has tracked executive sales job postings across the U.S. market. VP Sales. CROs. SVPs. Heads of Revenue. The full spectrum of senior sales leadership.

As of this week, we've accumulated 1,298 postings with enough structured data to analyze. That's salary ranges, required skills, preferred tools, methodologies mentioned, industries represented, and the specific language companies use when they're describing their ideal candidate.

What follows is what the data actually says. Some of it will confirm what you already suspect. Some of it won't.

The Skills That Actually Show Up

If you read one more article about "the future of sales leadership" written by someone who hasn't looked at actual job postings, I can't help you. But here's what 1,298 postings tell us about the words companies put in front of candidates.

According to The CRO Report's analysis of 1,298 job postings, data-driven decision making appears in 26.3% of VP Sales requirements — making it the fastest-growing skill demand in sales leadership.

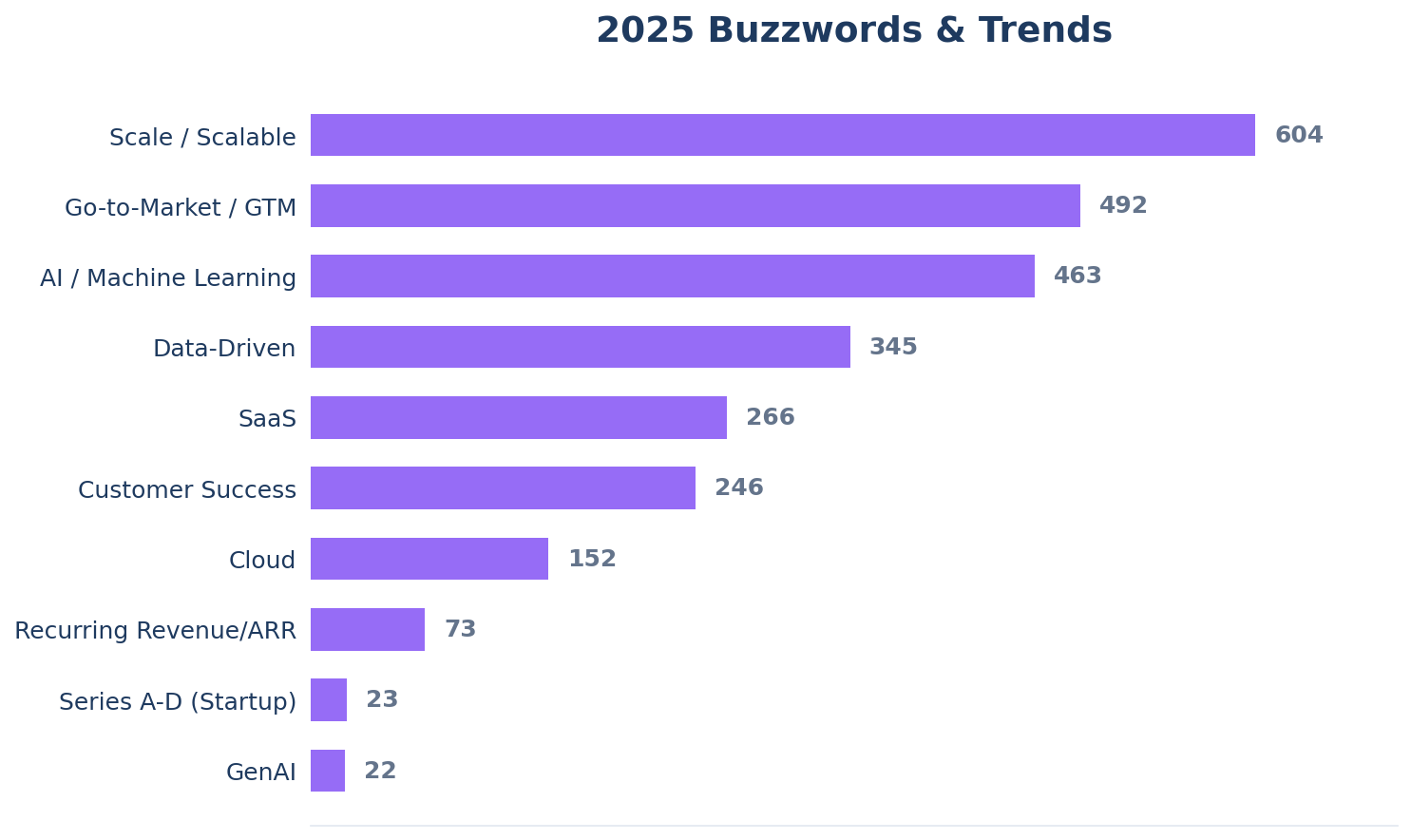

| Term | Mentions | % of Postings |

|---|---|---|

| Scale / Scalable | 591 | 45.5% |

| Go-to-Market / GTM | 488 | 37.6% |

| AI / Machine Learning | 411 | 31.7% |

| Data-Driven | 341 | 26.3% |

| SaaS | 262 | 20.2% |

| Customer Success | 244 | 18.8% |

| Cloud | 151 | 11.6% |

| Recurring Revenue / ARR | 72 | 5.5% |

| Series A-D (Startup) | 23 | 1.8% |

| GenAI | 21 | 1.6% |

"Scale" at 45.5% isn't surprising, but the margin is. Nearly half of all postings use some variation of "scale" or "scalable." Companies aren't looking for someone to maintain. They want builders. And the word has become so pervasive that it functions almost as shorthand for "we have ambition, and we need someone who's done this before."

GTM at 37.6% tracks with the ongoing blurring of sales and marketing functions at the leadership level. If you're a VP Sales candidate and you can't articulate a full go-to-market perspective, you're already behind a third of the field.

The real story is AI/ML at 31.7%. It's now solidly ahead of SaaS (20.2%). Think about that for a second. More companies are flagging AI in their VP Sales postings than are flagging SaaS. That's a full inversion from where we were two years ago. We'll unpack this more below.

Data-driven at 26.3% is table stakes at this point. One in four postings mentions it, which means three out of four assume it. Nobody's going to write "we want a VP Sales who doesn't use data." It's the baseline. If you don't have a data story for how you've run your business, fix that before you update your resume.

Down at the bottom: only 23 postings (1.8%) specifically reference startup stages like Series A through D. The startup VP Sales role hasn't gone away, but it's a small slice of a big market. And GenAI, for all the hype, shows up in just 21 postings. Companies want AI literacy. They're not yet sure what to do with GenAI specifically at the sales leadership level.

The Methodology Question

Sales methodologies are one of those topics where everyone has an opinion and almost nobody has data. So here's the data.

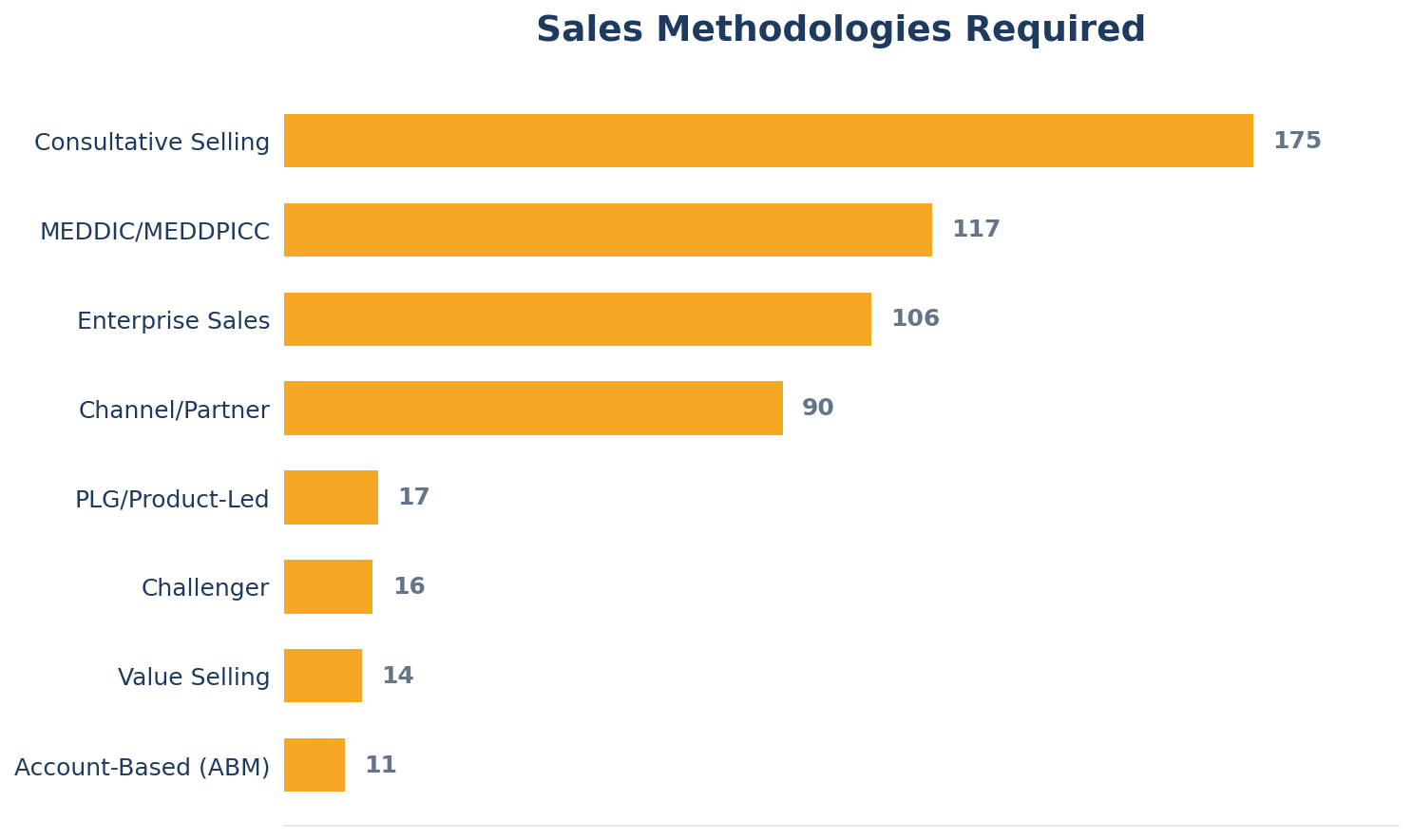

| Methodology | Mentions | % of Postings |

|---|---|---|

| Consultative Selling | 172 | 13.2% |

| MEDDIC / MEDDPICC | 117 | 9.0% |

| Enterprise Sales | 102 | 7.9% |

| Channel / Partner | 87 | 6.7% |

| PLG / Product-Led | 16 | 1.2% |

| Challenger | 16 | 1.2% |

| Value Selling | 14 | 1.1% |

| Account-Based (ABM) | 11 | 0.8% |

Consultative Selling tops the list at 172 mentions (13.2%). MEDDIC/MEDDPICC comes in second at 117 (9.0%). Enterprise Sales as a motion sits at 102 (7.9%), and Channel/Partner at 87 (6.7%).

But the most striking number here isn't on the table. It's what you get when you add all of these up and subtract from 100%.

87% of VP Sales and CRO job postings don't mention any specific sales methodology.

That's 1,131 out of 1,298 postings that reference no framework, no process, no named approach. The vast majority of companies hiring sales leaders either don't care about your methodology background or, more likely, care about results and assume you'll bring your own playbook.

What does this tell you? If you've been agonizing over whether to get MEDDPICC certified or bone up on Challenger, relax. Most companies won't screen for it. Where it does come up, Consultative Selling leads, and that's not really a methodology so much as a philosophy. Companies want sales leaders who understand their customers' problems. Not a shock.

MEDDPICC at 9% is meaningful if you're targeting enterprise SaaS roles specifically. It's become the default qualification framework for complex B2B sales. But for the market as a whole, it's a niche requirement.

PLG at 1.2% is worth noting for what it isn't. For all the Product-Led Growth discourse of the past five years, almost nobody is writing it into VP Sales job descriptions. Product-led companies still need sales leaders, clearly. They're just not calling the motion "PLG" in their postings. The same goes for ABM at 0.8%. The strategy is alive; the label, in the context of VP Sales hiring, is barely used.

The Tools You Need (and the Ones You Don't)

If you've spent the last two years building a "modern revenue tech stack" on your resume, brace yourself.

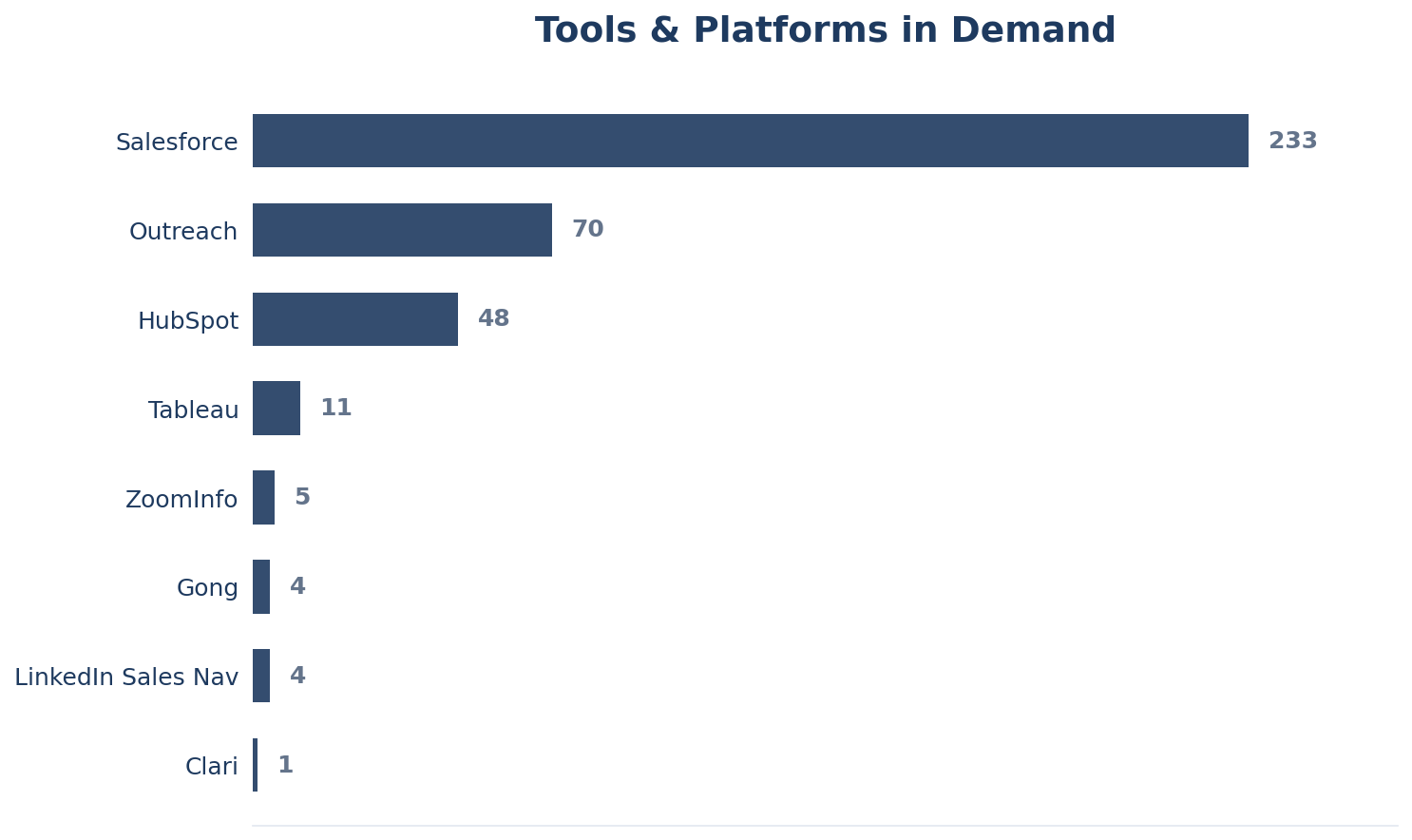

| Tool / Platform | Mentions | % of Postings |

|---|---|---|

| Salesforce | 180 | 13.9% |

| Outreach | 65 | 5.0% |

| HubSpot | 48 | 3.7% |

| Tableau | 11 | 0.8% |

| ZoomInfo | 5 | 0.4% |

| Gong | 4 | 0.3% |

| LinkedIn Sales Nav | 4 | 0.3% |

| Clari | 1 | 0.1% |

Salesforce. 180 mentions. 13.9% of postings. After that, it's a cliff.

Outreach at 65 (5.0%) and HubSpot at 48 (3.7%) are the only other tools that clear even a 3% threshold. Tableau at 11 barely registers. ZoomInfo at 5. Gong at 4. LinkedIn Sales Navigator at 4. Clari at exactly 1 posting out of 1,298.

The "modern sales stack" that vendors promote at every conference doesn't show up in hiring requirements. Companies are either not listing their tech stack in job postings, or they genuinely don't care which specific tools you've used. The likely answer is both. At the VP level, companies assume you can learn any tool. What they can't teach is the judgment to know which tools to invest in and which to cut.

Salesforce's dominance is structural. It's less a tool requirement and more a literacy check. Knowing Salesforce at the VP level means you can read dashboards, build reports, understand pipeline mechanics, and hold your ops team accountable. You don't need to be an admin. You need to be fluent.

If you're a VP Sales candidate and your resume lists seven tools in a "Technical Skills" section, consider trimming it. Nobody's hiring you for your Clari expertise.

Where the Jobs Actually Are

Ask most VP Sales candidates where they're looking, and they'll say tech. SaaS. Maybe fintech if they're feeling adventurous. And they're missing most of the market.

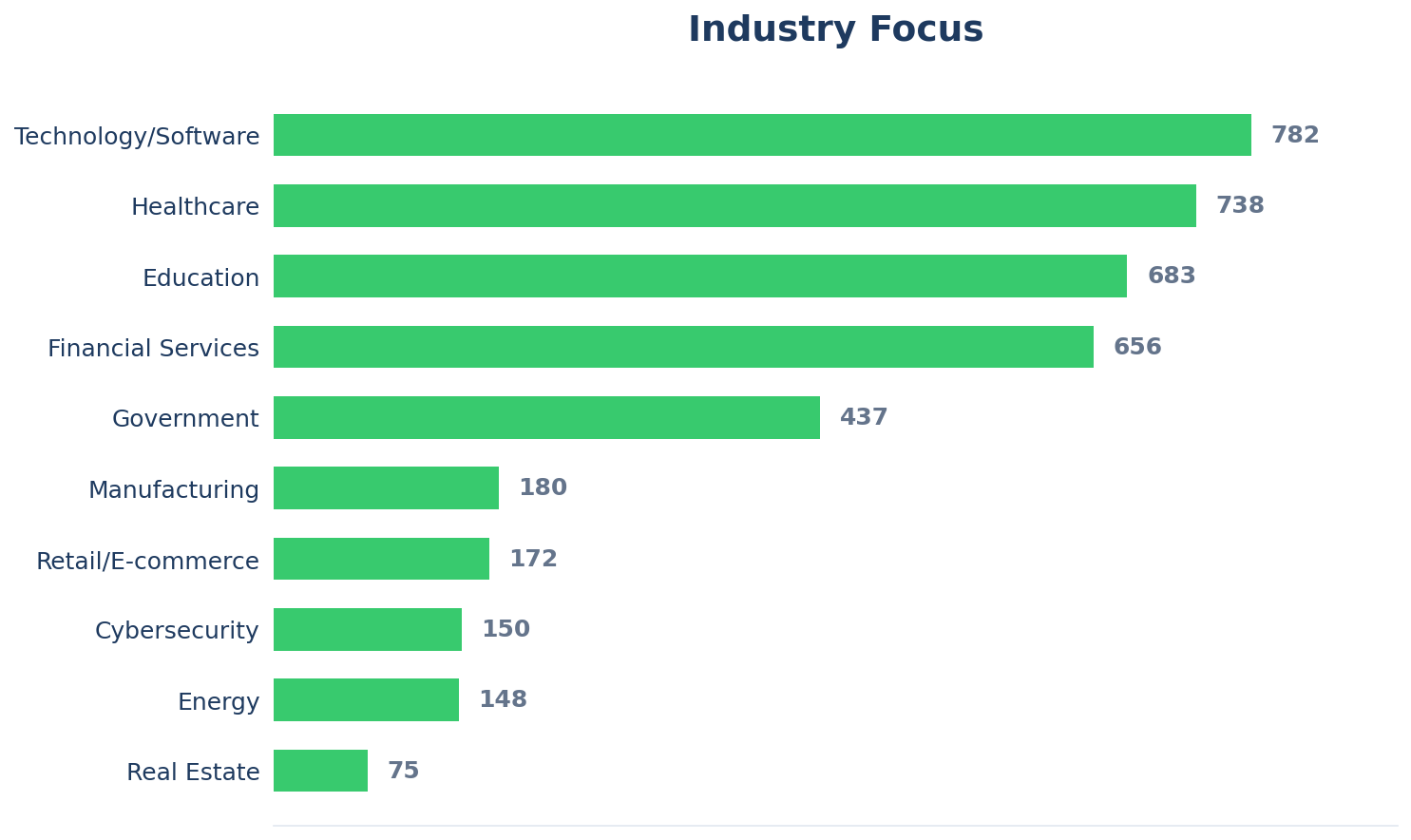

| Industry | Mentions | % of Postings |

|---|---|---|

| Healthcare | 720 | 55.5% |

| Technology / Software | 719 | 55.4% |

| Education | 626 | 48.2% |

| Financial Services | 589 | 45.4% |

| Government | 423 | 32.6% |

| Manufacturing | 176 | 13.6% |

| Retail / E-commerce | 170 | 13.1% |

| Cybersecurity | 145 | 11.2% |

| Energy | 137 | 10.6% |

| Real Estate | 72 | 5.5% |

Healthcare has passed Technology. 720 mentions vs. 719. It's essentially a dead heat, but the fact that Healthcare is even in the conversation at the top of this list should reframe how you think about your next role.

Healthcare companies are buying software, services, and infrastructure at a pace that requires experienced sales leadership. These aren't pharma rep jobs. They're VP-level roles at health tech companies, hospital systems buying enterprise platforms, insurance companies building digital channels, and clinical data firms scaling their go-to-market. If you've spent your career selling to CTOs, your skills transfer. The buyer persona is different, but the motion is familiar.

Education at 626 mentions (48.2%) is the surprise of this dataset. EdTech never fully went away after the pandemic surge, and now education institutions themselves are hiring sales leaders for enrollment, partnerships, and enterprise training divisions. Financial Services at 589 (45.4%) is exactly where you'd expect it, given the sector's size and ongoing digital transformation spend.

Government at 423 (32.6%) rounds out the top five. FedTech and GovTech continue to grow as public sector procurement modernizes. If you've got a clearance or experience selling to federal agencies, you're in a smaller and more valuable talent pool than you might think.

The bottom line: if you're only looking at pure software companies, you're competing in a subset of the total market. Healthcare, education, financial services, and government collectively represent far more VP Sales demand than technology alone.

The AI Imperative

411 postings out of 1,298 mention AI or Machine Learning. That's 31.7%. One year ago, that number was roughly half what it is today.

AI mentions now outpace SaaS mentions by a wide margin: 411 to 262. Companies that used to describe themselves as "SaaS companies" are increasingly describing themselves as "AI-powered" or "AI-first." Whether that reflects genuine product capabilities or marketing positioning varies, but the signal in job postings is clear: companies want sales leaders who can sell in an AI-influenced market.

What they actually mean by this varies wildly. In some postings, AI shows up as a product category: "You'll sell our AI platform to enterprise buyers." In others, it's a desired competency: "Experience leveraging AI tools to optimize sales processes." And in a growing number, it's both.

GenAI specifically appears in just 21 postings (1.6%). The broader AI/ML term dominates. Companies want strategic AI awareness, not necessarily expertise in prompt engineering or LLM architectures. They want a VP Sales who can talk to a CTO about AI without embarrassing themselves, and who can position an AI product against non-AI alternatives.

For your career, the practical implication is straightforward. You need an AI narrative. Not a certification. Not a blog post about ChatGPT. A coherent story about how you've used AI in your sales process, how you've sold AI products, or how you've adapted your team's approach in response to AI-driven changes in buyer behavior. Something concrete and specific.

After 15+ years in B2B sales, the pattern is familiar. In 2015, it was "cloud." In 2018, it was "data." In 2021, it was "PLG." Today, it's AI. The difference is that AI genuinely changes the selling motion in ways that cloud and data did not. Buyers are more informed, cycles are compressing in some segments, and the tools available to sales teams are evolving fast. You can't fake fluency here the way some people faked "cloud expertise" by adding it to their LinkedIn headline.

Red Flags to Watch For

Not every VP Sales posting is a good opportunity. Some of them are telling you exactly who they are, and it pays to listen.

| Phrase | Mentions | % of Postings |

|---|---|---|

| "Fast-paced environment" | 248 | 19.1% |

| "Competitive compensation" (no numbers) | 198 | 15.3% |

| "Self-starter" required | 85 | 6.5% |

| Travel 50%+ | 45 | 3.5% |

| "Scrappy" | 8 | 0.6% |

| "Wear many hats" | 4 | 0.3% |

"Fast-paced environment" at 248 mentions (19.1%) is the most common flag. Nearly one in five postings uses this phrase. Sometimes it's accurate and benign. Many companies are genuinely moving fast. But at the VP Sales level, "fast-paced" often translates to organizational chaos, unclear priorities, or a revolving door at the leadership level. Ask in the interview: "What was the tenure of the last person in this role?" and "How many times has the sales org been restructured in the past two years?" Those questions get you closer to reality than any job posting will.

"Competitive compensation" without specific numbers appears in 198 postings (15.3%). For context, only 54.8% of VP-level postings disclose actual salary ranges. Among the postings that use "competitive compensation" as a substitute for real numbers, our data shows the average disclosed base tends to land in the $167K-$251K range. When a company won't tell you what they pay, they're usually paying below market. The phrase "competitive" is doing heavy lifting it can't support.

"Self-starter" at 85 mentions (6.5%) is a softer flag. In some contexts, it means the company genuinely values autonomy and will get out of your way. In others, it means there's no infrastructure, no onboarding, no enablement, and nobody to help you figure out what happened before you showed up. The distinction matters. A VP Sales should absolutely be self-directed, but "self-starter required" at the VP level can indicate a company that hasn't invested in the support structures a sales leader needs to succeed.

Travel requirements of 50% or more (45 postings, 3.5%) and "scrappy" (8 postings, 0.6%) are rarer but worth noting. Heavy travel requirements at the VP level suggest the company either lacks a regional sales structure or expects the VP to function as a player-coach on major deals. "Scrappy" at a VP-level posting is a particularly revealing word choice. It's telling you the budget is thin, the headcount is low, and the expectations are high. That can be exciting at the right company. At the wrong one, it's a year of brutal work with no support.

"Wear many hats" at 4 postings is almost charming in its rarity. But when it does appear in a VP Sales job description, it's a direct admission that this isn't really a VP Sales role. It's two or three roles stitched together with a senior title. Proceed with full awareness.

Compensation Context

The data on pay deserves a brief mention here, though we cover it in depth in our VP Sales salary analysis and salary benchmarks.

Across 636 VP-level postings with disclosed compensation (a 54.8% disclosure rate), the average base salary range sits at $167,295 to $251,443. Remote roles account for 43.9% of postings, which continues to be a higher share than many people expect.

The trend line isn't great. Average maximum base has declined 10.1% over the past 9 weeks. That's a meaningful drop in a short period, and it suggests companies are tightening their top-end ranges even while demand for sales leaders holds steady. Whether that's a correction, a seasonal dip, or the start of a longer compression cycle, we'll know more in the coming weeks. The weekly newsletter tracks this in real time.

What This Means for Your Next Move

The data points in different directions depending on where you are in your career.

If you're actively interviewing: Focus on your "scale" story. Nearly half of companies want to hear it. Have a clear narrative about how you built a team, grew a pipeline, or expanded into new segments. Be ready to talk about AI. Not as a buzzword, but as something you've interacted with as a seller, a buyer, or a leader. And don't limit your search to tech companies. Healthcare, education, and financial services have as many or more openings, often with less competition for candidates.

If you're evaluating offers: Watch for the red flags above. Ask for comp data upfront. If they won't share it, that's information. Use The CRO Report's salary benchmarks to know whether an offer is at market. And understand that 43.9% of roles are remote, so you have leverage on location flexibility.

If you're not looking but want to be ready: Build your AI narrative now. Get fluent in your company's data stack, even if it's not your job today. Keep your Salesforce skills current. And read job postings in your target industries, not to apply, but to understand what companies are asking for. It's free market intelligence. That's exactly what we compile in the Market Intel section every week.

If you're a hiring manager: Your posting is competing against 1,297 others in our dataset alone. The best candidates are reading more carefully than you think. Disclose your salary range. Drop "fast-paced" unless you mean it. Specify what you actually need, not a wish list of every buzzword in this article. And if you genuinely need MEDDPICC experience, say so. If you don't, leave room for the candidate who's built three sales teams but never heard the acronym.